Income Protection Insurance: Ensuring Financial Stability During Unexpected Times

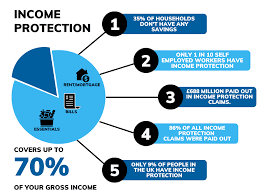

Income protection insurance (IPI) is a vital financial product designed to safeguard your income in the event of an illness or injury that prevents you from working. In today’s uncertain world, having a safety net to ensure financial stability when you are unable to earn can be crucial for maintaining your lifestyle and covering essential expenses.

What is Income Protection Insurance?

Income protection insurance is a type of policy that provides regular payments to replace part of your income if you become unable to work due to illness, injury, or disability. Unlike other insurance products that might offer lump-sum payments, income protection insurance focuses on providing ongoing support typically a percentage of your regular earnings, to help you manage your financial commitments while you recover.

Types of Income Protection Insurance

Short-Term Income Protection: This type of policy covers a temporary period, usually up to 12 or 24 months. It is designed to provide financial support during a short-term illness or injury. Short-term policies are often more affordable but may not offer coverage for long-term conditions.

Long-Term Income Protection: Long-term policies offer coverage until you return to work, reach retirement age, or in some cases, for the rest of your life. This type of insurance is particularly beneficial for those who want more extensive coverage and are concerned about the long-term impact of serious health issues.

Payment Protection Insurance (PPI): Although often confused with income protection, PPI is typically a short-term product that covers specific debts or loans, such as mortgages or personal loans, if you are unable to work due to illness or injury. PPI policies are generally less comprehensive than income protection insurance and focus on covering particular financial obligations.

Benefits of Income Protection Insurance

Financial Stability: The primary benefit of income protection insurance is maintaining financial stability during periods when you are unable to earn an income. This coverage can help you manage essential expenses, such as mortgage payments, utility bills, and daily living costs.

Peace of Mind: Knowing that you have a safety net if you fall ill or suffer an injury provides significant peace of mind. You can focus on your recovery without the added stress of financial concerns.

Coverage Flexibility: Income protection policies can be tailored to fit your specific needs. You can choose the level of coverage, the waiting period before payments begin, and the duration of the policy, allowing you to customize the protection according to your financial situation and health risks.

Support for Recovery: Many policies offer additional support services, such as rehabilitation and counseling, to help you return to work more quickly. This can be invaluable in managing both the physical and emotional aspects of recovery.

Choosing the Right Policy

When selecting an income protection policy, it’s important to consider various factors, including:

- Coverage Amount: Policies typically cover a percentage of your pre-tax income, usually between 50% and 70%. Consider your financial needs and expenses to determine the appropriate coverage level.

- Waiting Period: This is the period you must wait before receiving benefits. Shorter waiting periods result in higher premiums, while longer waiting periods can lower costs but may delay financial support.

- Benefit Period: Decide how long you want the policy to pay out benefits. Options include short-term coverage or until retirement, depending on your needs and preferences.

Conclusion

Income protection insurance is a crucial component of a comprehensive financial plan. It ensures that you can maintain financial stability and cover essential expenses if you are unable to work due to illness or injury. By investing in a suitable policy, you can safeguard your income, reduce financial stress, and focus on your recovery, knowing that your financial future is protected. Whether opting for short-term or long-term coverage, understanding your needs and comparing different policies will help you secure the best protection for your circumstances

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

No comments:

Post a Comment